A Comprehensive Guide to Investing in a Silver IRA

As the company strives for client success, investors may see better profits. By having a deep understanding of the entire process, we prepare documents designed to get you the http://www.chengxiaofan.com/souyi/if-you-do-not-silver-ira-companies-2023-now-you-will-hate-yourself-later.html best possible outcome in a default. Precious metal prices tend to act in opposition to the stock market: when equity prices are low, gold typically rides high. Most investors prefer direct transfers due to their convenience and cost savings benefits. The company will send you a physical guide and a digital copy you can access immediately. On Oxford Gold Group’s website. Increase Returnon Investment. Birch Gold Group has over 20 years of experience helping people open and maintain their gold IRAs. Augusta Precious Metals is another top brand in the Gold IRA market, known for their personalized service and commitment to transparency.

10 Birch Gold: Best for Precious Metals Education

Augusta Precious Metals and its precious metals specialists go the extra mile to make sure that both existing and potential customers receive all the information needed to make an informed decision. Finally, Augusta has excellent customer service and will work with you to help you make the best investment choices for your situation. The ability to make a confident yet informed investment decision can be made through investor education. All these experts help clients create a better retirement nest by creating new IRA accounts and facilitating the rollover of retirement funds into precious metals portfolios. The IRS permits one IRA rollover per calendar year. Furthermore, the company’s website includes customer only tools such as real time price monitors and precious metals market analysis. Check out our APMEX comprehensive review. Traditionally, they made bids and offers on the price of gold. JavaScript seems to be disabled in your browser. Additionally, you’re limited to just one rollover per year.

Things to Consider When Choosing a Silver IRA Company

If you want to hold physical gold in an IRA, the first step is to open a self directed IRA SDIRA — one that you manage directly — with a custodian. Discover the Value of Augusta Precious Metals Today. The choice is up to you. Looking for an investment. Historical performance is no guarantee of future results. The company specializes in making buying and selling gold, silver, platinum, palladium, and self directed IRAs as accessible as possible. Depending on the type of investment, the fees can range from one time setup charges to yearly maintenance costs. Whether you get any free silver is mainly dependent on the size of the initial deposit or rollover you are looking to make; and your ability to negotiate a deal. However, it is important to note that no metal is inherently more valuable than another as an investment, and each precious metal offers unique advantages in the market. Minimum purchase/funding requirements can vary per company, but set up costs, storage fees, and annual fees typically exceed $100 although you’ll pay less in set up costs at some platforms. Wiring fees: Precious metals IRA companies will typically charge a wiring fee for every outgoing wire. Let’s start with something familiar, such as American Gold Eagles and Gold Buffaloes.

The Best Gold IRAs

Palladium Bullion IRA: 3. If clients are looking for a company with a fantastic reputation, American Hartford Gold might probably be the best one. In 1990, the storied Australian Perth Mint launched its highly anticipated and followed silver coin series featuring Kookaburras. Normally, the value of gold increases when the market goes into a downturn, and investors move their wealth into gold as a hedge against inflation. Additionally, silver often carries lower maintenance and transaction fees than stocks or other investments, making it a cost effective way to build wealth over the long term. Audio Alert: Asset Managers, Industry Aggressively Snap Up Silver.

Noble Gold

The company helps build long term wealth by providing personalized investment advice to its customers. Once your funds have been transferred into the new Silver IRA, you will need to designate a bullion dealer or other approved entity as the custodian of your account. After being given false promises, including “no worries you are 99. Box 870 Murray, KY 42071 888. We do not knowingly collect information from children under thirteen 13 without parental consent. However, most gold ira companies” gold ira fees for investing also entail the following. However, when it comes to investing in gold, it is important to find a reliable broker or custodian to ensure the safety of one’s investments. Gold IRA custodians can also help investors understand the tax implications of investing in gold and provide assistance with filing the necessary paperwork.

Can Gold Coins Be Put Into Your Roth IRA?

Fine content is measured in Troy ounces. Used in real estate transactions, a hard money loan is granted by individual investors or companies, not banks, because they are generally a last ditch effort and riskier. Many experts feel that precious metals are a form of wealth insurance. Medicine’s growing silver use. This beautiful coin is struck by the Royal Dutch Mint from 1oz. Excellent Customer Service. You should consult with your appropriate legal, financial or tax advisor regarding issues arising from the acquisition or disposition of precious metals, rare coins, rare currency and any financial investment. If you are interested in purchasing Gold Bullion, Gold Coins, or Gold Bars outside of a retirement fund you have that option with our choices as well. At Accuplan, we use Delaware Depository in Wilmington, Delaware, for all our precious metals storage. Gold IRAs are complicated if you end up finding a service with terrible customer service and possibly something that is not a reputable gold IRA company. Gold: $50 Over Spot Per Ounce. A gold IRA requires a specialized custodian that can handle all of the necessary tax documentation and reporting, as well as deal with gold sellers, depositories, and shipping companies.

4 American Hartford Gold: Free Shipping and $10,000 in Free Silver on Qualifying Purchases

They won’t be able to pester you after that. Not only that; owning gold can be downright nerve racking if you’re storing prized bullion bars in your home. The Wall Street Journal recently reported on the radio advertising that promotes an ability to store gold owned by a self directed IRA at the IRA owner’s own home. For a traditional gold IRA. Date of experience: May 31, 2021. Transfers can take anywhere from 3 business days to 10 business days, depending on how quickly your custodian is able to send the funds. Advantage Gold is a reliable provider of gold and silver IRA investments. The team also evaluated the company’s financials to ensure that their financials were sound and that their investments were secure. Although they don’t meet the 99. Red Rock Secured is Gold IRA provider offering gold, silver and other investment tools. GoldCo, American Hartford Gold Group, Oxford Gold Group, Lear Capital, Noble Gold, Patriot Gold Club, Gold Alliance, Advantage Gold, Birch Gold Group, RC Bullion, GoldBroker and Augusta Precious Metals are some of the top names in the business of offering comprehensive services to help individuals and families invest in gold and silver IRAs.

Silver

This ensures your information is kept confidential and protected from any unauthorized access. Also, you should keep in mind the number of years the company has been in existence. Invest with Confidence Today. Investing in gold for retirement is a popular choice for many individuals looking to secure their financial future. By accessing any Advantage Gold content, you agree to be bound by the terms of service. The information contained on sbcgold. Experience the Power of Precious Metals with Birch Gold Group. Should ensure that Any transaction is possible with American Hartford Gold regardless of where the client is or when the Call is made. For example, gold bars must be 99. Upon selecting your custodian, you must choose your 3rd party non bank precious metals depository qualified under Internal Revenue Code IRC 408n. The IRS regulates and controls the products that can be added to your precious metals backed IRA. The founding team comes from technology, finance and real estate background, and streamlined the process with the client in mind. Canadian Maple Leaf Palladium CoinsPalladium Bars and Palladium Rounds produced by a refiner/assayer/manufacturer accredited/certified by NYMEX/COMEX, NYSE/Liffe, LME, LBMA, LPPM, TOCOM, ISO 9000, or national government mint and meeting minimum fineness requirements.

Pros:

The company accepts wire transfers. It is important to research the reputation and legitimacy of any gold IRA company before investing. Moving 3% to 10% of your overall Investment Portfolio into physical Gold and Silver lets you diversify away from traditional assets while creating a hedge against Inflation and market turmoil. The company offers a few benefits that set it apart from other gold IRA companies. American Precious Metals Exchange is one of the largest precious metals dealers specializing in precious metals for Gold IRA accounts. Below are a number of Augusta Precious Metals’ gold and silver items. Once you have opened the account, you can then transfer funds from your existing retirement account into the gold and silver IRA. Customer reviews and testimonials can be an extremely powerful tool when it comes to marketing your business. If that’s the case, you might consider executing a 401k to gold IRA rollover. Since their initial 1986 release, the Silver American Eagle Proof coins are the United States’s official version of the silver bullion coin.

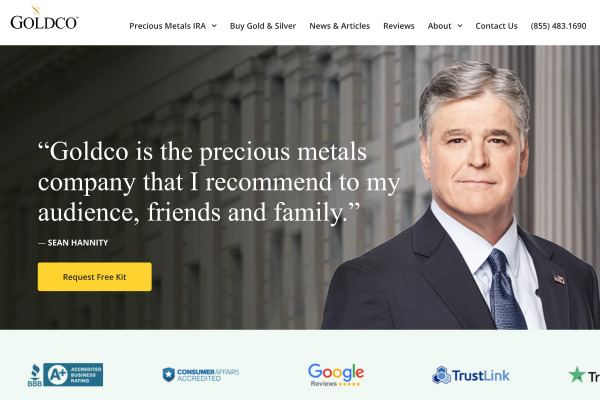

Goldco Products and Services

Open AccountBest for Low FeesStar rating: 4. Discover Why GoldCo is the Top Choice for Reliable Gold IRAs Invest in Your Future Today. Secure Your Financial Future With GoldCo Invest Now. Noble Gold is a popular choice for anyone looking to invest in a precious metals IRA. As a result, investors looking to increase their exposure to precious metals may want to consider opening a self directed precious metals IRA. Before making any decision, you should seek advice from an attorney or tax professional. If you opt for a transfer instead, the funds are sent directly to your gold IRA custodian, so there’s no chance of an added fee or penalty. This company has risen to the top because of its commitment to making the investment process simple and transparent. Gold must be at least. Again, you’ll need to speak to a custodian regarding this first. Some IRAs now allow storing digital currencies such as Bitcoin to diversify your investments further. May 30, 2023 Press Release. Subscribe to get complete access to Outlook Print and Digital Magazines, Web Exclusive stories and the Archive. “Mark is an excellent loan officer.

Share this entry

You can invest in different metals such as gold, silver, palladium, and platinum, or you can invest in a combination of all these metals. Download a PDF version of our Self Directed Gold IRA investment process for your future reference. Experience the Magic of Gold Alliance Now. Customers can request both of Adam Baratta’s books free of charge via their website. They can even help you figure out the best precious metals for your retirement goals, and how much and how often to invest. Madison Trust’s Self Directed Gold IRA gives you the freedom to do just that. For one, gold is not, in any way, affected by inflation. However, gold is a hedge against inflation.

I want to invest but I’m still confused how to proceed

When you open a Gold and Silver IRA, you can reduce your taxable income by the amount you invest each year and you won’t pay taxes on any of your gold profits until you cash out your IRA. It’s also important to understand the different types of Silver IRA providers and find the best one for your needs. Fill out the Trade Confirmation from FideliTrade and Investment Authorization Form from Madison Trust. Of course, a gold individual retirement account, just a traditional IRA, is subject to tax rules. They’ll have to fill out forms with their information, create an account, select the best products, and invest in them. The company matches each customer with a customer success agent who can help them through the investment process. You may purchase gold bars, coins, or other precious metals. See the full list of IRA approved gold coins. Goldco has been helping investors with Gold IRAs for 16 years and they have over 1,000 5 star reviews. As seller, you are the first to see the due diligence findings, enabling you to address issues and make corrections, and to ensure an appropriate strategy is put in place with which to avoid loss of value in negotiations. If clients trust the correct professionals, they’ll make sure there are no unfortunate mistakes when doing a silver IRA rollover.

Numismatics

These types of IRAs are typically simple to set up, with customers often able to start an account with a company in a short amount of time. Experience the Luxury of Oxford Gold: Invest in Quality and Style. One of the most attractive benefits of investing in a Precious Metal IRA is diversification. You can use the links below to find registered or other legitimate financial professionals. As for its selection of gold coins, you can invest in Gold American Eagle, Gold American Eagle Proof, Gold Liberty, Gold Phoenix, Gold Independence Hall, and more. Silver is seen as a safe haven asset and can provide stability and protection against market volatility. Our Second Choice Augusta Precious Metals has an excellent reputation for providing its clients with the best resources and industry information. Whether you are a new investor or an experienced one, taking the time to research and select a reputable company can make all the difference in your investment success. The company offers a buyback program and a free investment kit to educate investors on physical assets. Whenever you decide to work with a precious metals dealer, you must ensure they have a good consumer rating. As the premiere self directed IRA administrator, IRA Innovations is equipped to handle all the unique requirements involved with a precious metals IRA, such as arranging for storage in a depository institution of your choice, valuations for IRS reporting, and account administration. A+ rated global insurer of art museums and high value property. Our IRA specialists are available to guide you through our wide selection of IRA eligible products. Others suggest allocating up to 25%.

US Reviews

Check out some of the reasons for investing in gold in the following section. Look for the firm’s owners and key personnel, then do an internet search on those names. A free gold and silver guide. With a gold IRA, you can diversify your retirement portfolio and benefit from the potential of gold’s long term appreciation. You are legally allowed to do a 401k rollover and avoid paying taxes and penalties, but to do this you must follow the correct process. After all, if anything goes wrong or the company goes defunct while you have potentially thousands of dollars in assets invested with them, you’re going to want to know the names of the team members to pursue legal action. The set up fee with Lear Capital is $50, while the annual management fee is $260 for the first year.

Take Us With You

A Precious Metals IRA is simply a Traditional, ROTH, SEP, SIMPLE, Rollover, or Inherited IRA that owns precious metals and may include gold, silver, platinum, or palladium. For more information, please read our full disclaimer. This act expanded the investment options for IRAs beyond paper assets. However, they recommend Equity Institutional and Self Directional IRA as custodians. Dividend stocks can provide regular income in the form of dividends, and some companies have a history of increasing dividend payments over time. Goldco has been helping investors with Gold IRAs for 16 years and they have over 1,000 5 star reviews. Silver can be funded into your account as raw bullion, jewelry, or a qualifying ETF. Timely Opportunities Article. The company provides free shipping for silver and gold purchases to its customers in the US, while also offering international shipping, primarily to France.

Take Us With You

Additionally, certain foreign coins are eligible as well. Investors should evaluate the reputation and fees of the depository an IRA company uses to store its clients’ precious metals. The company promises to guide its potential clients in selecting precious metals, assist in creating a Precious Metals IRA, manage all the particulars of an IRA rollover, and offer continuous support as long as the IRA account is maintained. Jan’s intention is to finish the remodel within the 12 months and re sell it for $322,000. According to thousands of satisfied investors, the best gold IRA accounts in 2023 are. Knowing how much everything is going to cost beforehand means you won’t get any nasty surprises down the line so always read the small print carefully before signing anything. A gold IRA could be the perfect solution. Silver bullion coins, such as the American Silver Eagle or Canadian Silver Maple Leaf, are highly recognized and widely traded coins that are IRA approved silver. 2401 International Lane Madison, WI 53704Toll free: 800 236 4300.

SHARE BLUEVAULT WITH OTHERS

When people lost their retirements in the 2008 stock market crash, not only did those invested in gold not lose money but they even made incredible gains. You always pay much more than you need to if you fall prey to free promotions. Here are some of the main benefits. The company’s IRA silver services offer investors a secure and reliable way to diversify their portfolios with silver, making it an ideal choice for those looking to invest in the precious metal. Precious Metals and Foreign Currency. $10,000 account minimum. If you want to invest in precious metals with more freedom and liquidity, you might consider a gold ETF instead. As such, silver can perform better than gold regardless of what direction a market takes.